Interest on the ETF’s cash balances helps offset the cost of rolling from one set of futures to the next, ensuring a low performance discrepancy, the firm said.

ProShares Says Bitcoin ETF Has Matched BTC Price Closely, ‘Roll Cost’ Concerns Are Unwarranted

İlk ABD bitcoin vadeli işlem bağlantılı borsa yatırım fonunun (ETF) düzenleyicisi olan ProShares, türevlerin ticaretiyle ilgili maliyetlerin izleme hatalarına yol açacağına dair endişelerin asılsız olduğunu ve ürünün ilk günden beri bitcoin’in spot fiyat performansını yakından taklit ettiğini söyledi.

ProShares Bitcoin Strateji Fonu, Ekim 2021’de New York Menkul Kıymetler Borsasında BITO kodu altında işlem görmeye başladı ve yatırımcıların kripto para birimine sahip olmak zorunda kalmadan bitcoin’e (BTC) maruz kalmalarını sağladı. Dünyanın en büyük kripto fonu olan ETF, Chicago Mercantile Exchange’de (CME) listelenen düzenlenmiş ve nakit ödemeli bitcoin vadeli işlemlerine yatırım yapıyor.

From the very beginning, observers speculated BITO and other futures-based ETFs would significantly underperform bitcoin due to costs associated with rolling over, or selling expiring futures contracts and buying the next set. Usually, longer-dated futures contracts trade at a premium to those closer to expiry, a condition known as contango. The contango tends to steepen during bull runs, and the steeper the contango, the higher the costs, and the so-called contango bleed.

“Concerns about the roll costs are misguided; BITO has closely tracked bitcoin’s price since inception,” Simeon Hyman, global investment strategist at ProShares, told CoinDesk in an email interview. “Since its inception (through 7/18), BITO has returned -54.5% compared to -51.5% for bitcoin. And over half of that modest difference is BITO’s fee of 95bps per annum.”

Bitcoin’s recent rally and the resulting widening of contango at the end of June have revived concerns about the roll costs and strengthened calls for spot-based ETFs, which invest directly in bitcoin and eliminate the need to roll over positions. Since June 15, a number of traditional finance giants like BlackRock, Invesco and others have filed applications with the U.S. Securities and Exchange Commission (SEC) for spot-based bitcoin ETFs.

According to Hyman, BITO continues to closely track the spot price as the fund’s interest income from cash holdings compensates for the roll costs, which are closely tied to the level of interest rates in the U.S. economy.

“For a financial future with no storage costs, as is the case with the CME bitcoin futures, the futures contract premium should be in the ballpark of the term-equivalent interest rate. The Fed’s raising of the benchmark interest rate by 500 basis points since March 2022 has been a key driver of those premiums, and consequently the roll costs of a bitcoin futures strategy,” Hyman said.

“Here’s the key piece of the puzzle. BITO earns interest on its cash balances which are driven by those same term-equivalent interest rates, which offset the roll costs. The result is close tracking to the price movements of spot bitcoin,” Hyman added.

As Hyman says, one component of futures prices is interest rates, and the U.S. Federal Reserve has lifted its target range to 5%-5.25% to control inflation. Other variables include the price of the underlying asset, storage costs and convenience yield. The CME bitcoin futures are cash-settled, so there also no storage costs.

BITO earns interest from its cash holdings. The interest income is paid out in monthly dividends and covers the roll decay in the fund. BITO has paid dividends six times this year.

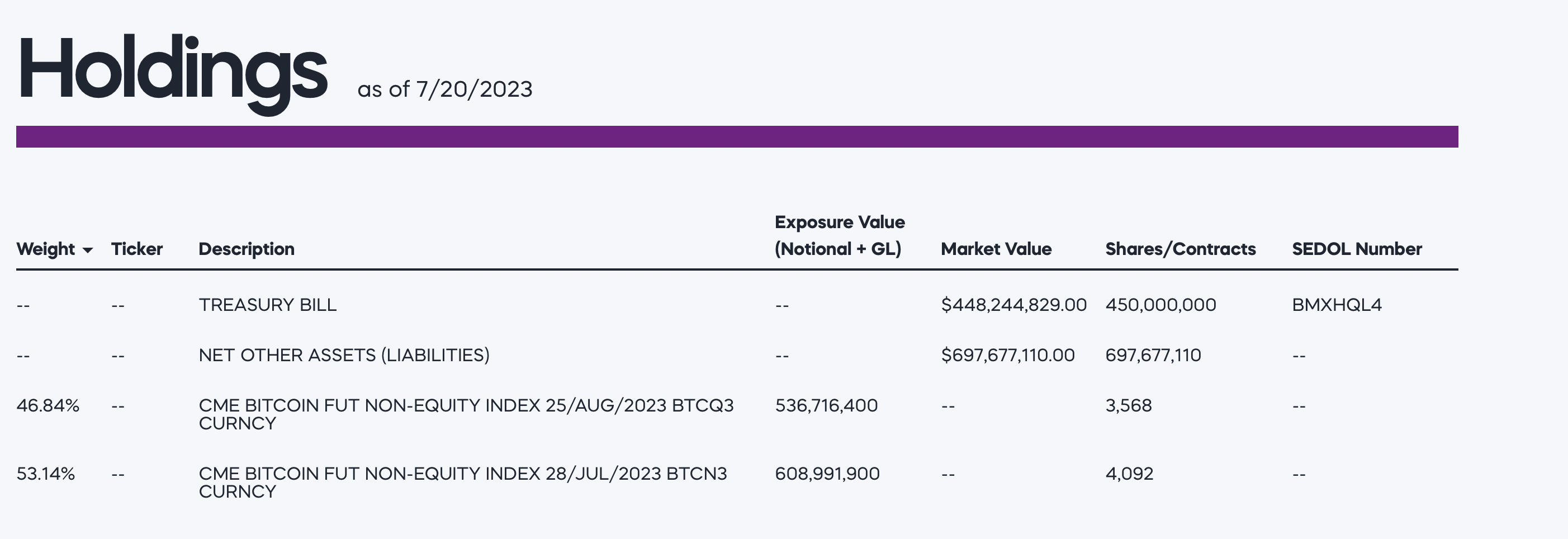

20 Temmuz itibarıyla ProShares, diğer varlıklar ve 28 Temmuz ve 25 Ağustos’ta sona eren CME vadeli işlem sözleşmeleriyle birlikte Hazine bonolarını elinde tutuyordu. (ProShares) (ProShares)

Potansiyel spot ETF’lerin yatırımcıları vadeli işlemlere dayalı ürünlerden uzaklaştırıp uzaklaştırmayacağı sorulduğunda Hyman, var olmayan ürünler hakkında spekülasyon yapmanın zor olduğunu söyledi.

Hyman, “BITO’nun performans ve akış geçmişi, bir ETF ve yatırımcı ilgisi dahilinde bir bitcoin vadeli işlem stratejisinin etkinliğinin bir kanıtıdır” dedi.

18 Temmuz itibariyle, ProShares ETF’nin yönetimi altında 1,1 milyar dolarlık varlığa sahipti. Yılbaşından bugüne 336,2 milyon dolarlık giriş gördü. Fon, başlangıcından bu yana 2,2 milyar dolarlık yatırımcı parası biriktirdi.

Piyasa, kurumsal para için taşkın kapaklarının kilidini açmak için spot tabanlı ETF’lerin potansiyel bir lansmanını bekliyor.