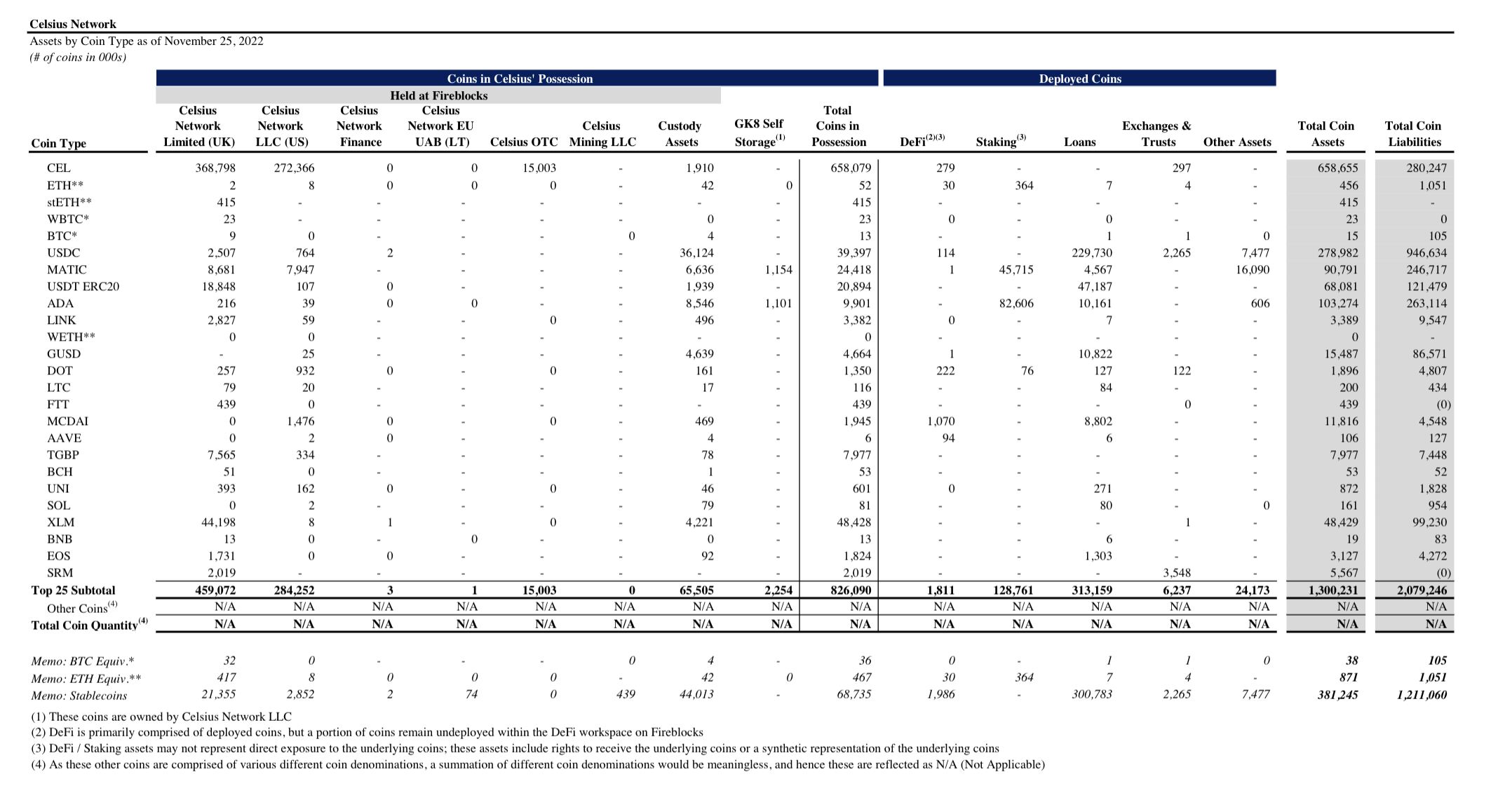

Court documents from last November give a rough picture of the lender’s altcoin holdings.

Celsius to Potentially Sell More Than $170M in ADA, MATIC, SOL and Altcoins for BTC, ETH

Kripto kredi şirketi Celsius, iflas işlemlerini denetleyen hakimin onayını takiben 1 Temmuz’da Cardano (ADA), Polygon (MATIC), Solana (SOL) ve bir avuç diğer altcoin’deki ana varlıklarını satmaya devam ediyor.

Geçen Aralık ayındaki mahkeme belgelerine göre Celsius, 25 Kasım 2022’de 90 milyon MATIC, 103 milyon ADA, 161.000 SOL, 3.3 milyon LINK, 1.8 milyon polkadot (DOT), 200.000 litecoin (LTC) ve 106.000 AAVE’yi kontrol etmekteydi. şirketlerin bu varlıklardaki mevcut pozisyonlarının ne olduğunu ve bunların ne kadarının satıştan çıkarılacağını netleştirin.

Those positions were cumulatively worth over $170 million at press time. Celsius has millions of dollars more in stablecoins as well as 650 million of its own CEL token. That tranche is theoretically worth nearly $100 million, according to Coinmarketcap, but it was unclear whether Celsius could liquidate its native asset.

Nevertheless, bankruptcy Judge Martin Glenn’s all-clear means Celsius will soon begin exiting many of its positions in favor of bitcoin and ether, the two assets that will ultimately be distributed to creditors who have waited nearly a year for their money back.

Celsius “may sell or convert any non-BTC and non-ETH cryptocurrency, crypto tokens, or other cryptocurrency assets other than such tokens that are associated with Withhold or Custody accounts … to BTC or ETH commencing on or after July 1, 2023,” Judge Glenn’s ruling said.

(Celsius mahkeme belgeleri)